Best Money Saving Tips For Your 20s

- Rebekah Gamble

- Jan 31, 2021

- 5 min read

Updated: Sep 24, 2021

How to save money in your 20s is a questions every twenty year old will ask eventually.

To save in your 20s or while in college could mean cutting back on breakfast and skipping out on buying lunch in favor of budget friendly at home meals. It can also mean getting creative and brainstorming other ways to save money fast.

But the real key to saving money comes from more long term habit changes like automating your finances, paying yourself first, and learning to live off of less.

When you’re able to take $10 a week and save it for 52 weeks you will have $520 dollars.

Or even taking $50 a month and placing it away in a low yield savings account like chase or a high yield account like ALLY can give you more financial control.

It also pushes you to be comfortable with the idea of building wealth.

Keep reading to find out a few habits that I developed while in college that made saving money while broke a lot more manageable.

Key take aways:

Limit your spending and stick to a budget at all cost.

Surrounding yourself with positive money influences is crucial to avoiding FOMO.

Bring in more income

So where do we start when it comes to how to save money in your 20s?

Pay yourself first

For someone who is new to budgeting the concept of putting money aside BEFORE they pay bills can sound daunting.

However this strategy for saving money fast was introduced to you the very first time you worked for a company that took out taxes. Your 40 hours of working per pay period earned you $600 but post taxes you only ever saw $480 dollars.

You can open a savings account or save your money in cash just make sure you commit yourself to saving an amount from each check.

If you buy breakfast in the morning and it adds up to $10 a week that can be the first $10 you put away.

Shopping with the intent of not buying food out can save you a lot when done correctly.

Build a Community

Since joining Instagram as @BlissfulWallet I have learned so much along the way through the people I follow. The pages I follow center on financial literacy, practicing self care and self love, as well as building wealth through investing.

Surrounding yourself with people (even if it’s virtual) is a great way to build connections and figure out what you want to do in life.

Some of my favorite accounts at the moment to follow are

@Bear.andthebull (Simplifies investing and financial literacy)

@FinancialLioness (Promotes money awareness, investing and building wealth)

@YasmineCheyenne (Promotes mental health awareness #JudgementFreeZone)

@TheNewMoneyPodcast (Promotes financial literacy)

Below you will see screen shots of each of their pages in the order listed.

Explore living options

At this age there are 3 types of adults.

There’s the blooming young adult who still lives at home and is planning to move out with time.

If this is the category you fall in make sure you do not move out and into a situation where you can not afford to pay your rent and keep food on the table.

One common struggle and mistake that a lot of people make is assuming they can afford a lifestyle that they simply can not (without a budget).

If you make $2500 every two weeks and your rent is $2000, you have to make sure you are aware of how much you are spending and stay within a budget.

Living off the remaining $500 when the first of the month hits can hurt if you do not plan properly.

Another student has moved into an apartment they can’t afford and refuses to downsize.

Sometimes reducing your rent and living expenses in a way that does not compromise your true values in life can be the best way to get ahead in life.

It’s likely not the apartment space that you’re enjoying (no matter how fabulous it looks) it’s the

peace that comes with having your own space

the sun peaking through your windows

the extra area that’s used as an office space

The walking room in the kitchen

the quiet

the elevator

the independence

Knowing your values makes living on your own easier and less expensive.

And lastly there’s the adult that reads up on “How to adult properly” “How to save money on a low income” and “What are some common money mistakes” so that when the time comes they are ready.

Buy Quality vs Quantity

Learning how to save money in your 20s also means splurging to save more money long term.

Have you ever washed a shirt and when it came out of the washing machine a million lint balls were born? Or have you kept replacing something that would break easily?

Sometimes spending extra money upfront is way more cost savvy for people of all ages, than saving a buck.

One time I bought a computer for $500 and it was incredibly slow so I returned it to the store. The next day I took $200 and bought a computer from a random electronic store with a zero refund return policy.

The computer ended up being slower and didn't have enough space to download chrome.

Sell your services

In highschool I had a love for essays.

I loved the way the words I typed could tell a story in a way my verbal words never could.

My writing gained much respect from my peers and even after several of them graduated, they tried to request my help with writing.

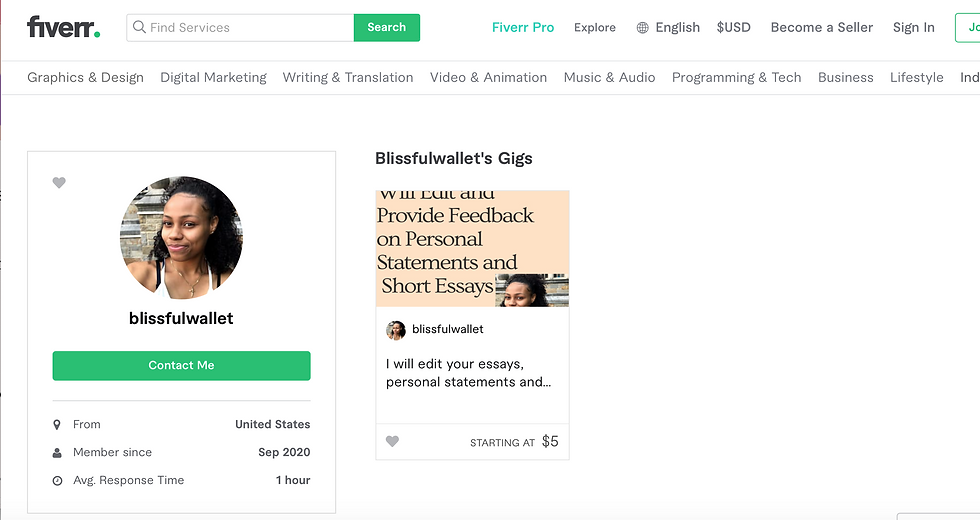

But by then I had my own academics to focus on and could no longer lend them my energy. But just think of how motivated I would have been to find time if I knew I could send them my FIVERR profile.

Fiverr is a freelancers dream website. A place where they can do something they’re good at naturally and charge $25 for it.

Maybe writing isn’t your thing but I bet you’re good at giving advice, editing pictures, doing math, or even posting on social media.

Use someone elses subscription password

Why pay for a service when you can use someone elses!

By sharing an account with some of the closest people in my inner circle I save $243.76 per year on Hulu (1/2 off student account with Spotify), Disney +, and Skillshare.

Skillshare is a great platform for learning new things you can click the picture for a 7 day free trial.

The alternative is to split the price in half so you both can save money.

Getting ahead in life is sometimes about compromising.

Get to know the experts

Eventually in your personal finance journey you will need assistance managing your money. Whether this is because you invested in yourself and started a business that grew or because you have different stock market investments, sometimes it's better to consult those who are certified to handle complicated money cases.

Even if this isn't you now, you're never too early to start learning different financial definitions while you're on your money saving journey. The next tip you learn could be the difference between an accountant, financial coach, and financial planner!

You can also view our GROWING list of book recommendations and see if any of the titles catch your eye!

In conclusion

The best way to save money in your twenties is to make sure you automate your savings and then spend as little as possible (without depriving yourself of the joys that life can offer.)

It doesn’t meant you never hang out with your friends instead think of it as a creative outlet because you can think of ways to hangout indoors.

You can make a game out of who can spend the least on groceries or who can come up with the best financial goals.

Once you see life as a set of choices that set you up for a better future it becomes easier to say no to retail therapy and find ways to practice free self care.

Let us know in the comments any thoughts you have or how you have been saving money so far!

I just came across your blog and this post in particular really resonated with me. I'm a 21-year-old who recently moved out of my parent's house and now have to grapple with buying groceries, paying my rent, and other bills, in addition to finding funds to cover transportation to and from work. Since moving, the term budgeting has really taken on a new meaning for me, I'll be sure to implement some of your suggested money-saving tips when I get next month's pay.